Casualty reinsurance for the data age

We provide AI-native underwriting and analytics platforms for casualty risk transfer

Driving the future of casualty risk transfer

Tailshift is an underwriting company specializing in casualty reinsurance. We work with cedants and capacity providers to deliver solutions for liability transfer and program support. Powered by the industry’s broadest insurance datasets and AI-driven analytics, we illuminate risk, uncover opportunities others miss, and deliver better outcomes post-close.

From broad data to sharp decisions

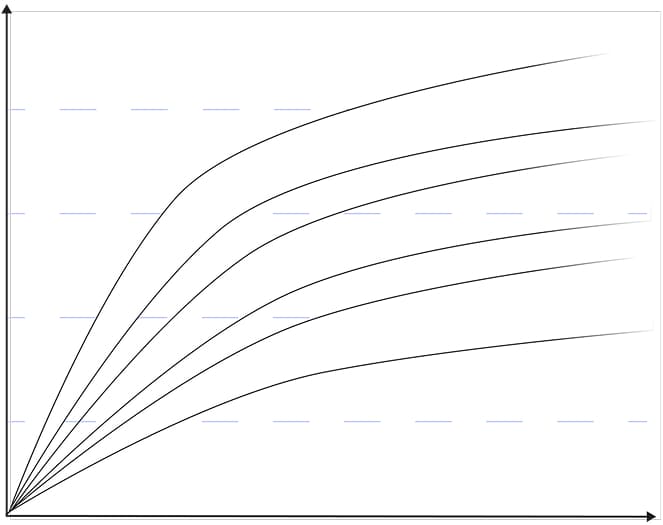

Expanding Data Advantage

We command a data asset of unprecedented breadth and depth, from tamed bordereaux-level performance data to unstructured claims notes, legal and medical records, and agent-driven searches. Spanning the full lifecycle of risk, this growing reservoir fuels insights others can’t reach.

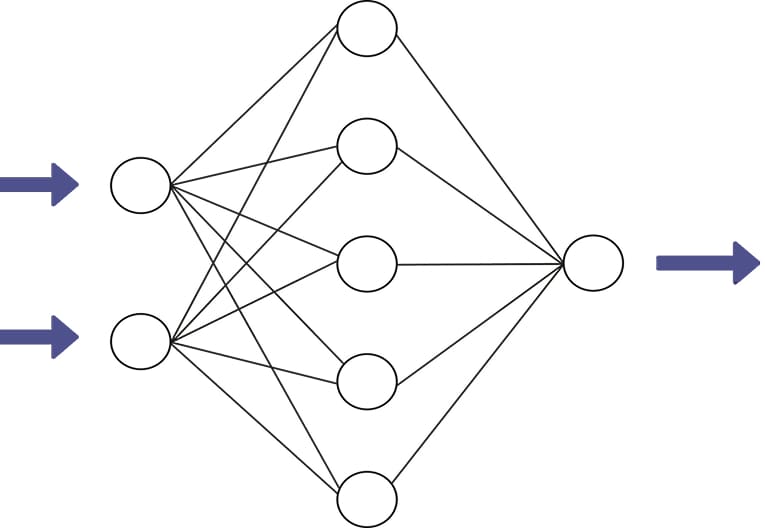

Decoding the Unstructured at Scale

Our AI models parse the unstructured insurance data others can’t, from decades of claims notes to dense underwriting narratives, extracting meaning at scale. Bottom-up analysis quantifies risk, benchmarks performance, and exposes patterns invisible to traditional review.

From Intelligence to Impact

We turn data-driven intelligence into stronger structures and sharper underwriting decisions, helping partners capture overlooked opportunities and achieve better post-close performance.

The engine behind better risk transfer

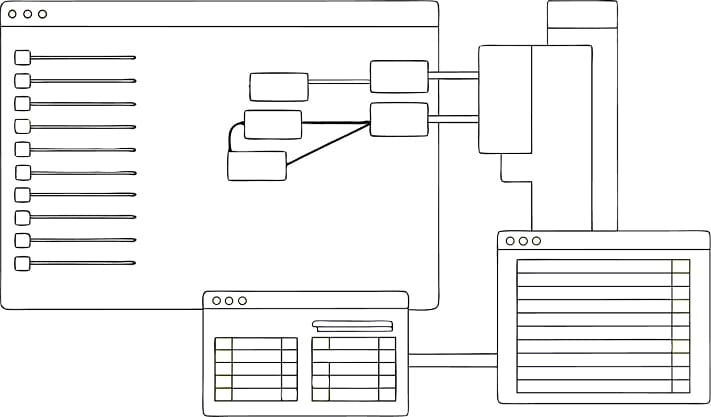

Constructed for Scale

Unified structured and unstructured datasets, cleaned and linked for a complete view of risk.

AI-Native Analysis

Proprietary models parse and interpret millions of records to price and structure deals.

Actionable Foresight

Predictive frameworks stress-test performance, flag emerging deterioration, and guide interventions for stronger results.

Smarter risk transfer starts here